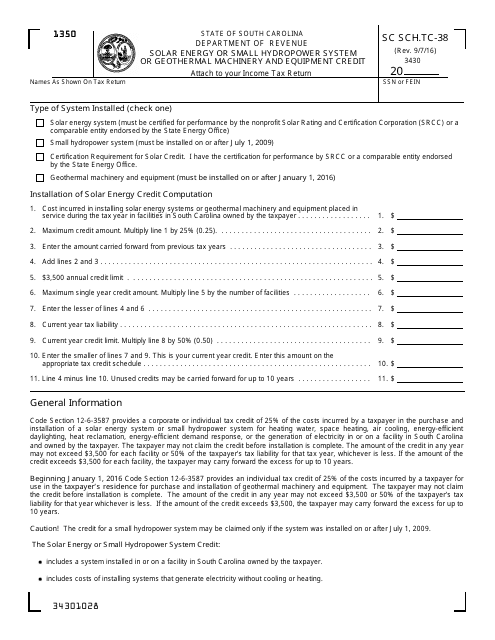

geothermal tax credit form

Claiming a geothermal tax credit is as simple as filing your taxes next year. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Download Form P87 For Claiming Uniform Tax Rebate Dns Accountants

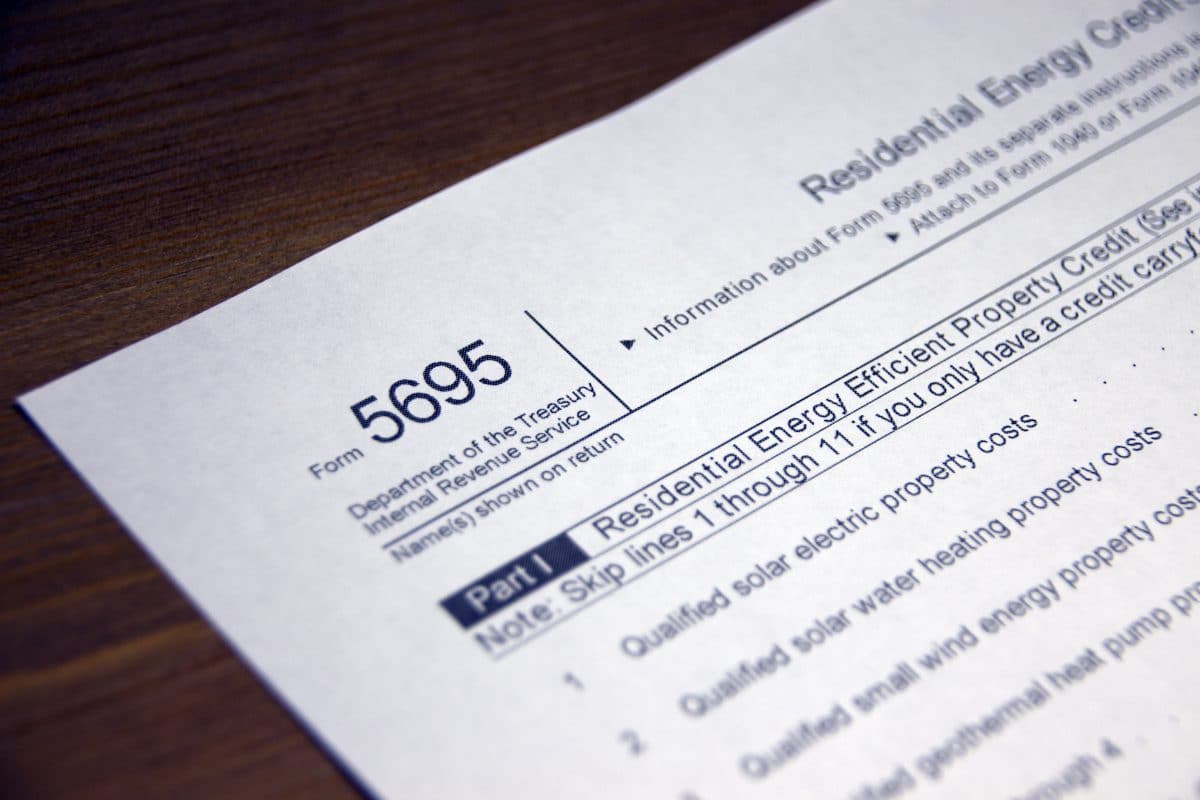

Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit.

. Unless amended the tax credit will extend until 31 December 2016. As long as your system is up and running by the end of 2022 you can claim. Therefore the signNow web application is a must-have for completing and signing fillable online understand the geothermal tax credit on the go.

Id like to get a geothermal pump for my house. Unused credits may be carried forward for up to 10 years. This geothermal heat pump tax credit was created by the Energy Improvement and Extension Act of 2008 HR.

Check Out The Residential Tax Incentive Guide. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. If you made energy saving improvements to more than one home that you used as a residence during 2020 enter the total of those costs on the applicable line s of one Form 5695.

The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. Renewable Energy Tax Credits. April 20 2021.

You may be able to take a credit of 26 of your costs of qualified solar electric property solar water. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on January 1 2022 or later.

Find Everything about Geothermal tax credits and Start Saving Now. Because they use the earths natural heat they are among the most efficient and comfortable heating and cooling technologies. Installation address must be in Iowa.

For property placed in service after 2009 theres. The tax credit equaled 10 of the taxpayers qualified. Use Form 5695 for systems installed since Jan.

The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023. 30 for systems placed in service by 12312019. You may still carry forward any remaining tax credit until the carryforward period expires.

I think using the ground to heat water sounds like an efficient use of energy. Get more information about each incentive below. 3 Responses to Tax credits for energy saving Chance Cook August 4 2021.

Include this form and the IA 148 with your IA 1040. For qualified fuel cell property see Lines 7a and 7b later. Geothermal System Credit Form ENRG-A December 30 2021.

When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump. Tax Credits Rebates Savings. Get fillable online understand the geothermal tax credit signed right from your smartphone using these six tips.

This Tax credit was available through the end of 2016. You may use this form to claim your geothermal system credit. This includes labor onsite preparation equipment assembly and the necessary piping and wiring used when connecting the system to the home.

IA 140 Geothermal Tax Credit - 41-169. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. The incentive will be lowered to 22 for systems that are installed in 2023 so act quickly to save the most on your installation.

You may not claim this credit after Tax Year 2021. Did you know going green could save you some green on your taxes. Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return.

From biomass stoves to wind turbines to solar water heaters there are all sorts of different credits out there you can claim on your returns. Iowa Geothermal Tax Credit httpstaxiowagov 41-169a 072317 Names SSN Part I Information about the geothermal heat pump system 1. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

Certain electrical upgrades may also be eligible. The Federal Investment Tax Credit applies to both solar and geothermal. This credit was repealed by the 2021 Montana State Legislature.

Clean Energy Tax Credits. While the bill mainly targets homeowners small business and commercial owners may be eligible for a 10 tax credit for their geothermal heat pump investment. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022.

Geothermal Tax Credit Explanation. Ron Wilson December 8 2017. This tax credit allows you to deduct 26 percent of the cost of installation from your federal taxes.

The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps. Residential Energy-Efficient Property Credit. Tax Day is just around the corner.

The credit for solar energy or small hydropower systems cannot exceed 3500 for each facility. Maybe I can find other geothermal products out there that I can use every day. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now.

The IRS issues federal tax credits themselves. For systems completed in 2008. The tax credit is 26 for systems placed in service by 12312022.

The credit for geothermal machinery and equipment can only be claimed for one facility. Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. Calculate the credit.

If you are claiming the credit in a carryforward year begin with this line. In a matter of seconds receive an electronic document with a legally-binding eSignature. To apply for the tax credit complete IRS form 5695 as part of your tax return.

Ad Look For Geothermal Tax Credits Now.

Form Sc Sch Tc 38 Schedule Tc 38 Download Printable Pdf Or Fill Online Solar Energy Or Small Hydropower System Or Geothermal Machinery And Equipment Credit South Carolina Templateroller

Filing For Residential Energy Tax Credits What You Need To Know

How You Can Get Energy Efficiency Rebates And Tax Credits Energy Efficiency Solar Energy Diy Solar Energy Companies

How You Can Get Energy Efficiency Rebates And Tax Credits Energy Efficiency Solar Energy Diy Solar Energy Companies

Britain Goes Coal Free As Renewables Edge Out Fossil Fuels Carbon Sequestration Offshore Wind Power Plant

Renewable Energy Surges To Record Levels Around The World Renewable Sources Of Energy Climate Change Effects Solar News

Types Of Energy Turbine Coloring Sheet Coal Energy Concentrated Solar Power Biomass Energy

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

A Geothermal Resurgence Masscec Geothermal Geothermal Heating Geothermal Heat Pumps

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

World Potential Renewable Energy Map Biomass Solar Wind Hydroelectricity Renewable Energy Hydro Electric Energy

How To Claim The Solar Tax Credit Boston Solar Ma

25 Easy Ideas For Living Green Green Solutions Go Green Green

Comments

Post a Comment